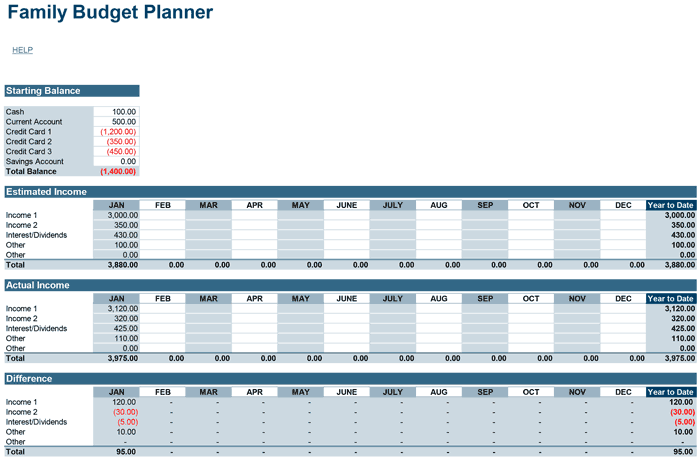

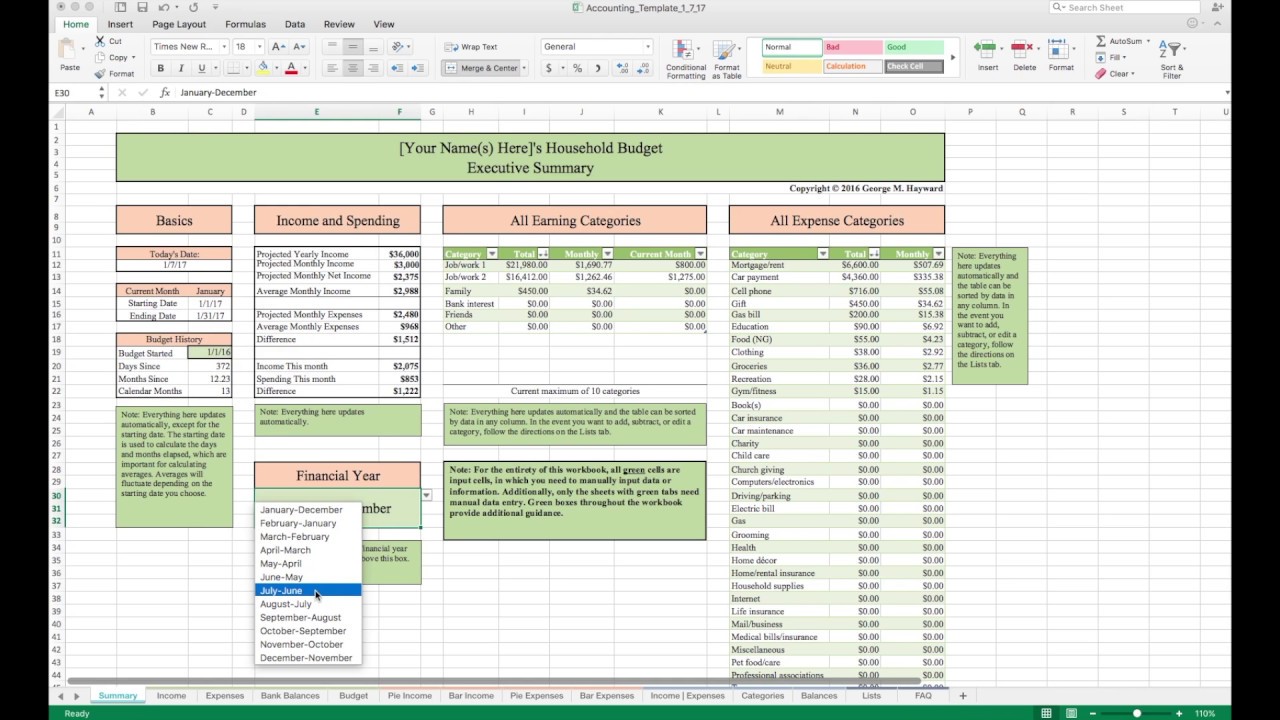

You no longer need to spend hours manually setting up a personal finance spreadsheet from scratch Money in Excel does it for you in just a few seconds. If you're trying to maintain a realistic budget, the Consumer Financial Protection Bureau (CFPB) recommends creating a budget spreadsheet or worksheet to track your income and expenses.Once your financial accounts 3 are connected, Money in Excel will automatically import your transaction information from all your accounts into one workbook. That way, you can budget your money appropriately for your needs. Spreadsheets help you to see how much income you have, as well as how your money is spent. Much like a business, a person benefits from using a spreadsheet for their finances because it places all the information they need in one easy-to-read place. All of these entities use spreadsheets for creating budgets, tracking spending, and creating reports for their financial matters. Since then, the technology has been adopted by businesses, banks, and governments. Learn about all of your options, here.ĭan Bricklin and Bob Frankston created the first financial spreadsheet program in 1979.

Managing your personal finances can seem like a daunting task, but it doesn't have to be: There are many budgeting and personal finance spreadsheets readily available online. Budgets help you plan for your monthly expenses, activities, needs, and even your financial future. One of the best methods for managing personal finances is to create a budget.Ĭreating a budget can help you keep your finances organized and also control the amount of debt you might require to live the way you want. Basic living expenses need to be maintained for a reasonable quality of life, which can be attained by most people if they manage their finances correctly.

0 kommentar(er)

0 kommentar(er)